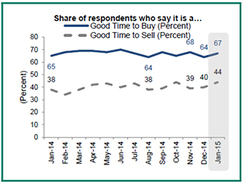

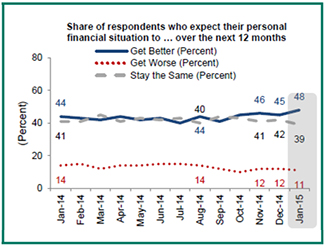

Consumer optimism toward the housing market gained some momentum in January following a dip in December, likely getting a boost from their increasingly positive financial outlook, according to results from Fannie Mae's January 2015 National Housing Survey™. The share of respondents who said their household income is significantly higher than it was 12 months ago rose 4 percentage points to 29 percent, and the share expecting their personal financial situation to improve over the next year increased to 48 percent – both all-time survey highs.  After dropping in December, attitudes toward purchasing a home have improved: • The share who said it is a good time to buy a homeincreased 3 percentage points to 67 percent. • The share saying they would buy rather than rent if they were to move jumped 5 percentage points to 66 percent. • This marks the first increase since September 2014.  "Consumers are as positive about their personal finances at the start of 2015 as they have been since we launched the National Housing Survey in 2010, and this optimism seems to be spilling over into housing market attitudes," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "Consumers are more optimistic about the environment both for buying and for selling a home today and the share who plan to own on their next move has jumped back up, reversing a three-month trend toward renting. These results are in line with lender optimism about future growth in their mortgage origination business, as shown in our Mortgage Lender Sentiment Survey™." Overall, these are good signs to start off 2015 and are consistent with our expectation that strengthening employment and economic activity will boost the speed of the housing recovery. Fannie Mae's monthly national consumer attitudinal survey report provides indicators offering a window into the opinions of Americans across the country. These behavioral insights convey what consumers think about the outlook for owning and renting a home and about their household finances, and may serve as key inputs for determining the future course of investment across housing types. Find the full release here with highlights from the survey results. Article provided by HomePath® Agent Matters - March 2015

Please contact us to help make your real estate goals a reality! Cornerstone Real Estate 321-765-3222 YourCornerstoneRealEstate.com

1 Comment

|

|

|